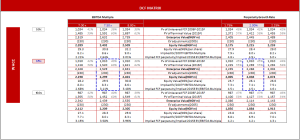

What Is DCF Analysis

You can download a sample of a DCF Analysis from this link http://www.dropbox.com/s/jzlyl7gbem1e3pt/Simple%20DCF%20Analysis..xlsm

The Discounted Cash Flow (DCF) Analysis is one of the most common valuation methods. It is predicated on the theory that the value of an enterprise or asset is the sum of the expected future cashflows discounted at an appropriate rate (cost of capital).

The DCF Analysis :

- Derives the inherent value of the enterprise/ asset

- By determining the Net Present Value(NPV) of the future cashflows( i.e. future cash receipts and outflows) generated by the enterprise or asset to all providers of capital (i.e. the unlevered free cashflows/”Unlevered FCF”)

- Using the Weighted Average Cost of Capital (“WACC”) as a discount rate to reflect the time value of money and riskiness of cashflows

- As of a specific valuation date.

The DCF analysis is provides a theoretical framework for deriving the intrinsic value of an enterprise or asset.

Information Required for a DCF Analysis

- Historical Financial Statements

- Projected Financial Statements

- Cost Capital Assumptions

- Terminal Value Assumptions

Key Steps to in DCF Analysis

- Information Gathering

- Forecasts

- Terminal Year Normalisation

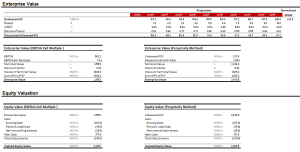

- Terminal Value Calculation

- Determination of WACC

- Calculation of Enterprise Value

- Calculation of Enterprise Value, Adjustments and Equity Value

Over the next few weeks, we’ll go through a case study and develop a simple DCF analysis by going through the 7 steps stated above.

You can download a sample of a DCF Analysis from this link http://www.dropbox.com/s/jzlyl7gbem1e3pt/Simple%20DCF%20Analysis..xlsm

Very beautiful and simple model. However, I was thinking we could do a run through the model probably via a webex meeting platform or skype to have a full understanding of the model.